Content

Conditions and exceptions apply – see your Cardholder Agreement for details about reporting lost or stolen cards and liability for unauthorized transactions. You will need to itemize your deductions if you want to deduct your charitable donations. Many people find that it’s worth it to itemize these deductions – particularly if you give regularly to your church. Even if you have an IRA and contribute without an employer’s help, you can still get a tax benefit. Your traditional IRA contribution is an “above the line” deduction, meaning you don’t have to itemize in order to take advantage of it.

For example, if you drive for a rideshare company, you can deduct not only the mileage put on your car but expenses for registering it, servicing, oil changes, gas, and tire maintenance. While deductions and credits can be helpful, they don’t always have a large impact on your refund . NerdWallet strives to keep its information accurate and up to date.

Top 10 deductions that too often elude taxpayers

On the bright side, if you keep a record of your winnings and losses, you can deduct your losses (as long as they don’t exceed the amount of income you report on your return). And just like with other large loans, a good portion of your payments will be interest on what you originally borrowed — though refinancing can sometimes help with that. To claim this credit, students should receive a Form 1098-T from their school by the end of January. When the credit is applied, if it brings the amount of tax you owe the IRS down to zero, it will return up to $1,000 to you in a refund. However, you can not avoid tax liability simply by the label that you give a transaction. The IRS is going to look at the real purpose—the substance—of the transaction and tax it according.

Business owners can claim both credits and deductions, as long as they meet the necessary qualifications. Here are a few credits that many business owners may be eligible to claim on their 2022 tax return. A tax deduction reduces how much of your business income is subject to taxes by potentially putting you into a lower tax bracket. A tax credit is more straightforward in that it reduces the amount of tax owed by giving you a dollar-for-dollar reduction of your liability. For instance, a tax credit valued at $500 will lower your bill by $500.

Student loan interest

Tax evasion, on the other hand, is an attempt to reduce your tax liability by deceit, subterfuge, or concealment. Trusted clinical technology and evidence-based solutions that drive effective decision-making and outcomes across healthcare. Specialized Dont Overlook These 7 Top Tax Breaks For The Self in clinical effectiveness, learning, research and safety. If you are like most investors, you occasionally will pick a loser that declines in value. Sometimes, a security can even become totally worthless when the issuing company goes out of business.

- If you own a home and itemize, you can deduct the interest that you pay on your mortgage.

- There are many valuable tax deductions for freelancers, contractors and other self-employed people who work for themselves.

- Fees to doctors, dentists, specialists, mental health professionals and even nontraditional medical practitioners.

- In fact, the tax laws have given the IRS special powers to deal with specific areas where related taxpayers have historically used their relationships to unfairly reduce their taxes.

- Mike concludes that closing this deal indicates that he is worth far more to the company than his $30,000/year salary.

- The amount you can claim maxes out at $8,000 for one dependent and $16,000 for two or more.

- Remember, whatever your tax situation, TurboTax Deluxe, Premier, and Home & Business will ask simple questions and scour more than 350 deductions and credits to help you find those that apply to you.

There are several government obligations that may take us away from our normal routine. In particular, military activities and jury duty are two of the most time-consuming obligations that can prove costly in various ways. To help remedy this, there are various tax deductions for some of these situations.

Personal Finance

Homeowners benefit from a number of tax deductions, including those for mortgage interest, points, property taxes, and home office expenses. There are more deductions available than those listed here, but these are some of the biggest ones. Credit card processing fees, tax preparation fees, and repairs and maintenance for business property and equipment are also deductible. Other business expenses can be depreciated or amortized, meaning you can deduct a small amount of the cost each year over several years. Some people don’t like paying insurance premiums because they perceive them to be a waste of money if they never have to file a claim. The business insurance tax deduction can help ease that dislike.

- Before you take a deduction, make sure you can prove that you are entitled to it, and consider consulting a tax professional about your eligibility.

- Keep receipts for public transportation or mileage logs for your car (for which you can charge the standard $0.14 per mile rate for charitable organizations), as well as receipts for parking and tolls.

- Calculated on the first $2,000 socked away ($4,000 for married couples), the maximum credit for the 2022 tax year is $1,000 for an individual and $2,000 for married couples filing jointly.

- This $100,000 qualifies for the compensation deduction, but the $350,000 is a disguised dividend which does not qualify for the deduction.

If you’re close to overcoming the standard deduction, however, don’t forget to deduct the premiums you pay forlong-term care insurance. This counts as a medical expense deduction, which means you can only deduct the amount of your qualifying medical expenses that exceed 7.5 percent of your adjusted gross income. If you had adjusted gross income of $50,000, for example, you could only deduct the medical expenses that exceed $3,750. We will not represent you before the IRS or state tax authority or provide legal advice.

Tax Deductions for Homeowners

Premiums for business insurance, employee accident and employee health insurance. The plan also minimizes deductions for business losses, although the specifics are not available as of this post. A top capital gains tax rate increase from 20% to 28%, leaving the 3.8% net investment income tax in place. If you have capital gains and want to reduce your tax burden for those gains, investing in anOpportunity Zone can help you defer tax payments. Opportunity Zones were created as part of the Tax Cuts and Jobs Act of 2017. The income that you earn from your job is taxed at ordinary income rates, and the result is that you pay a high tax rate if you are a high earner.

It may also help keep a gambling diary with the time, date, location, amount won or lost, and gambling type. Many parents with school-aged kids have heard of529 savings https://quick-bookkeeping.net/independent-contractor-invoice-template/ plans. These are tax-advantaged accounts, with funds solely for educational purposes. This is where the deduction for jury pay paid to the employer comes into play.

Other Overlooked Tax Deductions

The same goes for maintaining a business website and any billboard space your company pays for. Keep track of how much you spend on advertising throughout the year and hold on to those receipts. The good news is that the government enables you to write off half of what you pay in these taxes so you don’t have to pay income tax on this amount.

- The sales of personal protective equipment are expected to increase from $13.5 billion to an estimated $24.3 billion in 2024.

- Doing the tax calculations and picking the method that results in the lowest overall tax liability for the family is a wise course of action.

- So we definitely are not in the mood for tax pranks or jokey misinformation.

- (Deductions cut your tax bill in proportion to your tax bracket.) Consider these seven tax-cutters.

You can claim the deduction as an adjustment to your income rather than an itemized deduction. Then there are some tax credits, again available regardless of which deduction method you use, that too often slip through the filing cracks. Credits are even better than deductions because they directly reduce dollar-for-dollar what you owe Uncle Sam. However, if you’re not investigating all of the tax credits and deductions out there, you’re passing up the chance to get a hefty tax refund.

So start getting those receipts out now – because you can claim the costs of travel and lodging for you and your family, moving household goods, and shipping your cars and your beloved pets! And that’s good news for the men and women we thank for bravely serving our country. The AOTC is worth up to $2,500 (100% of the first $2,000 spent and 25% of the next $2,000 spent on qualifying expenses). This credit is partially refundable — if deducting this credit brings your tax balance to zero, 40% of the remaining amount of this credit (up to $1,000) may be given back to you as a tax refund.

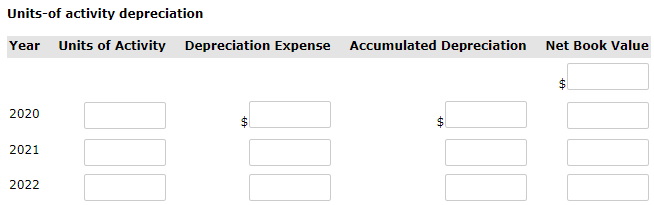

You must use your smartphone or internet service for business, and your employer — if you have one — must not reimburse you. For “bigger” stuff like computers or special equipment, the general rule is that you can deduct them in the year you buy them if their useful lives are a year or less. If their useful lives are longer than a year, the IRS may view those things as assets that depreciate over time.